Patients and PMB’s (Prescribed Minimum Benefits)

Do you know that most medical schemes have to cover the treatment of over 5,500 diagnoses?

– regardless of your insured benefits!

With increasing healthcare costs and new technology, as well as varying benefit designs on medical scheme plan options, patients find themselves in the situation, much earlier in the year than before, where they have run out of insured benefits.

The Prescribed Minimum Benefits (PMB) legislation was introduced to ensure that patients receive a minimum of care for a defined group of conditions or injuries, despite the registered benefits of their medical scheme plan option. The legislation forms part of the Medical Schemes Act No 131 of 1998.

What conditions and illnesses?

- All emergency medical conditions

- 270 medical and surgical conditions

- 25 chronic diseases

An emergency medical condition means the sudden and, at the time, unexpected onset of a health condition that requires immediate medical treatment and/or an operation.

If the treatment is not immediately available, the emergency could result in weakened bodily functions, serious and lasting damage to organs, limbs or other body parts, or even death.

The list of 270 medical and surgical conditions, also referred to as the Diagnosis Treatment Pairs (DTP’s), includes all major conditions, cancers and injuries of the heart, brain, lungs, bones and other vital organs. For these conditions, it is important to ascertain which diagnostic codes are included and exactly what treatment and care is included.

The 25 most chronic conditions listed on the Chronic Diseases List (CDL conditions) are included in the 270 PMB conditions. They are however specified in more detail in the form of legislated treatment steps.

25 Chronic Disease List conditions

- Addison’s Disease

- Asthma

- Bipolar Mood Disorder

- Bronchiectasis

- Cardiac (heart) Failure

- Cardiomyopathy

- Chronic Obstructive Pulmonary Disorder i.e. emphysema

- Chronic Renal (kidney) Disease

- Coronary Artery Disease

- Crohn’s Disease

- Diabetes Insipidus

- Diabetes Mellitus, Types 1 & 2

- Dysrhythmias

- Epilepsy

- Glaucoma

- Haemophilia

- Hyperlipidaemia (high cholesterol)

- Hypertension

- Hypothyroidism

- Multiple Sclerosis

- Parkinson’s Disease

- Rheumatoid Arthritis

- Schizophrenia

- Systemic Lupus

- Erythematosus

- Ulcerative Colitis

What should be covered?

All costs related to the:

- Diagnosis

- Legislated treatment

- Care costs

The scheme must cover the costs incurred during the process of making the diagnosis of a PMB condition. This includes, but is not limited to, consultations, blood tests, ECG’s, x-rays, scans and diagnostic procedures such as gastroscopies and colonoscopies.

The treatment is well-defined for the 25 chronic diseases, including comprehensive care such as the diabetic patient’s annual follow-up at the ophthalmologist and the regular blood tests for the patient with renal failure.

For the other PMB’s it is important to read the legislation carefully, in order to establish what is covered for your specific condition. Treatment can be very specific, i.e. chemotherapy or 21 days in hospital, or comprehensive, i.e. medical, surgical. Where surgery is included, even the costs for the prosthesis and other products must be covered in full.

Medical treatment includes prescription drugs and medication. Included also are healthcare services such as costs of rehabilitation, physiotherapy for a spinal injury patient and speech therapy for a stroke patient.

The care costs for your condition include all the additional products required to manage your PMB condition, such as plaster casts, insulin syringes, colostomy bags, wound dressings and bandages.

The ICD-10 code details your diagnosis. It is important that your treating doctor, pharmacist, hospital etc, must supply the correct and clinically appropriate ICD-10 code on all accounts, prescriptions, blood tests, x-ray requisition forms and scheme communications – otherwise it might not be paid! Don’t leave your doctor without your ICD-10 code

What about my insured benefits?

Your scheme is not allowed to pay for any of your PMB conditions from your medical savings account.

The scheme must pay the cost of the diagnoses, legislated treatment and care costs, despite the insured benefits on your chosen medical scheme option. The payment is not allowed to come from your medical savings account component!

They have to cover the full costs regardless of your chosen medical scheme plan option subject to managed care processes to manage costs i.e:

Treatment exclusions

The scheme might specify that hip replacements are excluded – but must cover the costs thereof, if done for a PMB condition such as a broken hip.

Limits on specific benefits

Even if your scheme limits a specific benefit – they must still pay for any additional costs, even after the benefit is depleted.

For example, (i) pay for a second scan if it is performed for a PMB condition such as a brain bleed, despite a scan benefit of only one scan per family per year, (ii) pay for your high cholesterol medication despite a limited chronic medication benefit, or (iii) pay the full costs of your heart valve prosthesis despite the fact that it might be more than your prosthesis limit.

Place of service

If you are on a hospital-only plan, the scheme must still pay for your out-of-hospital expenses such as consultations, medication or treatment, i.e. antibiotics for your middle ear infection, eye drops for an eye injury, x-rays and plaster cast for a broken ankle, and management of the 25 chronic diseases.

General exclusions

Your scheme might exclude suicide attempts or dangerous sports such as bungee jumping – but they must cover the full costs if the condition or injury is a PMB condition.

Schemes’ rights and responsibilities

Schemes are allowed to put the following measures or processes in place to manage costs:

- Treatment protocols and benchmark treatment

- Medicine formularies, lists of specific medicines

- Pre-authorisation or registration processes

- Appoint designated service providers (DSP’s) to render services for the PMB conditions to the patients on a specific plan option. A scheme can thus appoint, and insist, that a member goes to a specific group of GP’s, specialists, hospitals and pharmacies, even those in the State sector.

- Schemes have to cover, at minimum, the standard of care provided in the State sector, including investigations, prosthesis and medication.

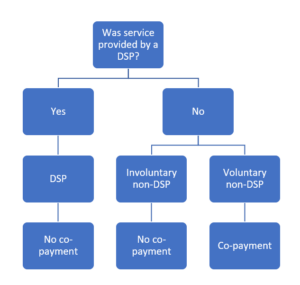

If you adhere to the above, then the scheme has to pay the costs in full. When you choose to visit a non-DSP or use non-formulary medication, then the scheme may impose a co-payment. This can be the difference between the amount charged and the chosen DSP’s fee or a percentage of the fee.

However, if (i) the formulary medication wasn’t effective, or (ii) if the patient had no choice but to visit a non-DSP, an involuntary non-DSP service, then the scheme must pay the costs in full.

Involuntary is when:

- The scheme hasn’t appointed a DSP

- DSP couldn’t render the services without unreasonable delay

- Service is not available from the DSP

- Immediate care/treatment was required

- DSP not within reasonable proximity

Patients’ rights and responsibilities

Patients cannot expect healthcare professionals to be fully aware of the 300 different medical scheme plans’ appointed DSP’s, pre-requisite or insured rates.

It therefore remains the patients’ responsibility to familiarise themselves with the PMB-related processes and conditions of their individual schemes.

Patients are therefore advised to

- Obtain the correct ICD-10 code from their service providers, i.e. doctor and pharmacist

- Enquire with their scheme whether it is a PMB condition; if so, are there any pre-requisites such as:

- Mandatory registration processes

- Designated Service Providers

- Treatment protocols and formularies

- Ensure that the scheme processes and reimburses all PMB-related accounts correctly

- Where appropriate, ensure that the scheme pays your service provider in full for DSP and involuntary non-DSP services.

Schemes tend to demand considerable paper work to validate the non-availability of their DSP.

Doctors responsibility

In terms of section 6 of the National Health Act of 2003 and section 53 of the Health Professions Act of 1974, the treating doctor must inform the patient of the fee which he intends charging for services rendered.

Doctors should also inform the patient of the long term benefits of quality care with a co-payment, for expert service or non-formulary medication vs short term saving by eluding a co-payment.

And if my scheme doesn’t comply?

Should you not be successful in solving your PMB-related queries with the call centre of your scheme, then address it with the schemes’ principal officer and the schemes’ dispute resolution committee.

If that fails, contact the schemes’ regulatory body, the Council for Medical Schemes on (012) 431 0500.

See www.spesnet.co.za/patients for more info, PMB conditions, waiting periods & schemes excluded.